Research | Policy Briefs

Inflation Reduction Act of 2022

48E

48E Clean Electricity Investment Tax Credit

(IRA Section 13702)

Background

The 48E Clean Electricity Investment Tax Credit (ITC) (IRA Section 13702) was recently updated and expanded as part of the Inflation Reduction Act (IRA) to lower the cost of installing and operating renewable energy projects (wind, solar and hydropower equipment). (source)

What is it?

48E offers a technology-neutral tax credit for a qualified investment in facilities generating clean electricity or energy storage technology placed in service on or after January 1, 2025. (Projects placed in service prior to 2025 fall under the Section 48 Energy Credit.)

The credit has the potential to drive utility- and commercial-scale decarbonization primarily in the power and building sectors by offsetting costs associated with renewable energy, including solar, wind, energy storage, and geothermal heat pumps.

What types of projects/businesses are eligible?

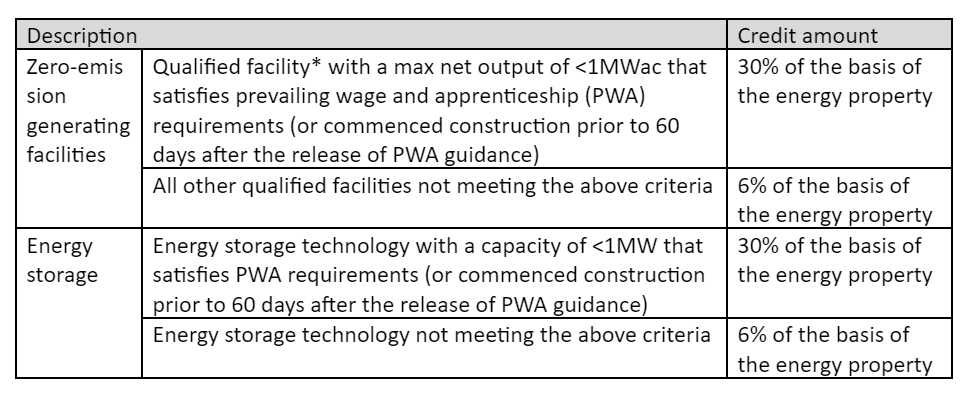

Projects meeting the qualifications outlined below are eligible for the tax credit. The credit amounts for zero-emission generating facilities and energy storage are below:

*Qualified facility: a facility that generates zero-emissions electricity that is not eligible for the following credits: 45 (renewable electricity production); 45J (advanced nuclear power facility production); 45Q (carbon oxide sequestration), 45U (zero-emission nuclear power production); 45Y (clean electricity PTC); 48 (energy credit); 48A (advanced coal projects)

In addition to the base credit, businesses can claim the following:

a credit of 5x the base if they meet prevailing wage and apprenticeship requirements

a 10% increase from the base if they meet domestic content requirements for steel, iron, and manufactured products

a 10% increase if they locate the project in an energy community

a 10-20% increase for qualified solar or wind facilities in low-income communities* (see table 2)

*NOTE: The Low-Income Communities Bonus Credit program allocates 1.8 GW of capacity available for the 2023 program across the above four categories of solar or wind facilities with maximum output of less than 5 MW. For the 2023 program year, at least 50% of the capacity of each category is reserved for projects meeting certain ownership and/or geographic selection criteria as outlined in the Final Regulations and Revenue Procedure. The US Department of the Treasury and IRS issued final rules and procedural guidance for the program in August 2023.

How do businesses take advantage of it?

The 48E tax credit is available at 100% of its value to projects placed in service between January 1, 2025 and the later of (a) 2032 or (b) when US GHG emissions from electricity are 25% of 2022 emissions or lower. Following this point (the “applicable year”), the credit starts to phase down (to 75% the second year after the applicable year, 50% the third year, and 0% the fourth year).

Tax-exempt organizations can receive the credit as direct pay for a 10-year period beginning on the day that the qualified facility was placed in service. This tax credit is also transferable, meaning that businesses that do not qualify for direct pay can transfer part or all of the credit to a third-party buyer in exchange for cash.

Importantly, businesses eligible for the 48E tax credit can be classified as 5-year property via the modified accelerated cost recovery system (MACRS) under the IRA’s Provision 13703, making them eligible for the MACRS depreciation deduction. MACRS allows businesses to lower their tax liability and recover the capitalized cost of an asset over 5 years through annual deductions.

The relevant tax form for the 48E ITC is expected to be released in advance of the 2024 tax filing season. To qualify for the Low-Income Communities Bonus Credit Program, businesses must participate in a competitive application process through the DOE Office of Economic Impact and Diversity. The Office will begin accepting applications on October 19, 2023.

Will the government be sending out future additional guidance?

In addition to the relevant tax form for the 48E credit, the DOE Office of Economic Impact and Diversity is expected to release additional information about the Low-Income Communities Bonus Credit Program. Although the US Department of the Treasury and IRS has issued final guidance, a complete applicant user guide is expected to be issued prior to the application opening date of October 19, 2023.

What other IRA incentives are available for clean energy projects?

The IRA extended or implemented a number of tax credits for the production of and investment in clean energy technologies and projects. In addition to the 48E ITC, the IRA implemented the complementary 45Y clean electricity production tax credit (PTC). Unlike ITCs—which reduce liability based on a percentage of an investment’s upfront cost in the tax year that the facility is installed—PTCs reduce federal income tax liability annually (during the period of eligibility) based on a percentage of a facility’s electricity production. Businesses must claim either the PTC or ITC.

Beyond the 45Y PTC, other tax credits are available for the manufacturing and use of specific technologies critical to power sector decarbonization. These credits include the 45U nuclear power PTC, 45Q carbon oxide sequestration credit, 45V clean hydrogen PTC, 45X advanced manufacturing PTC, and 48C advanced energy project credit, to name a few.

Furthermore, grant and loan programs bolstered by the IRA, such as the Rural Energy for America Program (REAP) and Solar for All, offer additional incentives for clean energy projects in certain communities. These incentives may be offered directly through federal agencies (such as the US Department of Agriculture, in the case of REAP) or states and municipalities responsible for allocating federal funding, and stacked on top of tax credits.

Additional Resources