Research | Policy Briefs

Inflation Reduction Act of 2022

45V

45V Clean Hydrogen Tax Credit

(IRA Section 13204)

BACKGROUND

The IRA introduces a clean hydrogen production tax credit (PTC) and broadens the existing investment tax credit (ITC) in Section 48 of the Internal Revenue Code (Code) to apply to hydrogen projects and standalone hydrogen storage technology. The Act further bolsters the hydrogen economy by enabling taxpayers to stack bonus credits and to capitalize on direct pay, as well as allowing the transferability of hydrogen-related tax credits. (source)

What is it?

The 45V production tax credit (PTC) (IRA Section 13204) offers tiered credits to hydrogen producers with lifecycle greenhouse gas (GHG) emissions between 0.45 and 4 kg carbon dioxide equivalent (CO2e) per kg of hydrogen produced.

What types of projects/businesses are eligible?

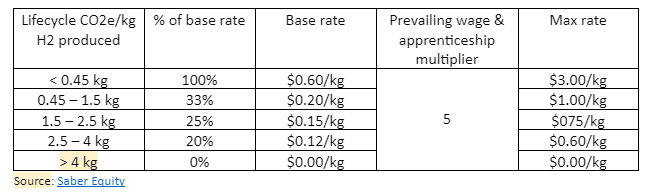

Companies that produce hydrogen with a lifecycle GHG emissions rate of 0.45 kg CO2e or less receive the maximum base rate of $0.60/kg of qualified clean hydrogen (QCH) produced. Producers can receive 20%, 25%, 33%, or 100% of the base rate per the table below. In addition, they can increase their PTC by a multiple of 5 if they meet prevailing wage and apprenticeship requirements. Thus:

The maximum value of the tax credit is $3/kg (i.e. producers with lifecycle GHG emissions rates of 0.45 kg of CO2e or lower who meet prevailing wage and apprenticeship requirements).

The minimum value is $0.12/kg (i.e. producers with the highest lifecycle emissions rate eligible for the PTC who do not meet prevailing wage and apprenticeship requirements).

How do businesses take advantage of it?

The 45V tax credit is available to facilities placed into service after December 31, 2022 and before January 1, 2033 for their first 10 years in service. Producers can also opt to receive the credit as an investment tax credit (ITC)—equal to a specified fraction of their capital expenses—rather than a PTC, which is a specified dollar value per kg of hydrogen produced. (However, the PTC is usually more valuable).

Tax-exempt organizations can receive the credit as direct pay for up to 5 years for facilities placed in service after December 31, 2012. For tax year 2022, qualified tax-paying hydrogen producers were instructed to fill out line 8 (special adjustments) of IRS Form 8835 for the renewable electricity production credit. For 2023, consult the IRS website for the most up-to-date information on guidance and the relevant form to submit during tax season.

What are the challenges with 45V?

Section 45V(f) of the US Code states that the Secretary of the Treasury shall issue regulations or other guidance for determining lifecycle GHG emissions related to the 45V tax credit no later than 1 year after the enactment of the IRA (by August 16, 2023). However, Treasury has not yet issued guidance, despite conflicting suggestions from industry and a lack of unified system calculating the emissions intensity of electrolysis-based hydrogen. Key issues revolve around three pillars of a potential GHG emissions accounting system:

Additionality: Additionality dictates that electrolyzers be powered by new clean energy, rather than 1) existing clean generation potentially redirected from power supply or 2) fossil fuel-powered generation offset by renewable energy credits. Proponents argue that the exclusion of an additionality requirement could necessitate the addition of new fossil fuel generation to fill the gap in generation for power supply, while opponents claim that current permitting and interconnection bottlenecks would significantly delay clean hydrogen deployment.

Deliverability: refers to electrolyzers receiving power directly from local clean generation.

Time-matching: describes a system in which energy attribute credits (EACs) are generated to represent individual units (typically MWh) of clean power generated over a particular period—typically hourly, monthly, or yearly. The debate over time-matching as it relates to GHG accounting for the 45V tax credit revolves around annual versus hourly time-matching. In an annual matching framework, EACs can be used at any time during the year, whereas under an hourly matching scenario, EACs can only be used in the same hour that the clean energy was generated. While some hydrogen and renewable energy companies (such as First Solar, EDP Renewables, Electric Hydrogen, and others) argue for hourly matching, with an 18-36 month transition period away from less stringent annual matching, other industry members claim that hourly matching would be too costly, with negligible additional emissions reductions.

What solutions can spur hydrogen deployment while keeping overall emissions low?

Utilization of in-service dates to satisfy additionality requirements

To simplify the process of determining additionality, the IRS could allow companies to satisfy the additionality requirement by using an ‘in-service’ date - in other words, the date that a facility commences its regular, commercial operations.

Allowance for regional market deliverability

When direct sourcing is not possible, the IRS could allow power to be sourced from the same grid to which the electrolyzer is connected to avoid congestion and transmission line losses.

Phased approach to time-matching

To address concerns around the feasibility of hourly time matching, Treasury can first allow annual time-matching to satisfy ‘clean’ hydrogen requirements. Then, as policy, regulatory, and market trends speed permitting reform and clear interconnection queues for renewable energy (and costs for renewable energy, battery storage, and electrolyzers decline) by the end of the decade, hourly time-matching can displace annual time-matching requirements by 2030.

Establishment of contracts for difference (CfD)

The US can implement a program similar to the EU’s CfD scheme, under which the state sets a fixed price for green hydrogen via an auction and covers the difference between the wholesale and fixed price. In July 2023, a group of companies active in hydrogen supply chains—including Cummins, Linde, Hyundai, and Toyota—called for flexible, 10-year CfDs to scale green hydrogen in the US.

RTO implementation of hourly EACs in tracking registries

Most of the country already has hourly matching capabilities, but few regions/RTOs track hourly EACs. PJM—the first RTO in the country to accommodate hourly certificate claims–offers a model for broader implementation. PJM’s Generation Attribute Tracking System (GATS) became the first registry in the US to provide hourly time-stamped carbon-free energy certificates in March 2023.

Complementary incentives to speed permitting, transmission, and interconnection queue reform

Legislative and regulatory efforts to clarify cost allocation for transmission projects, engage states on regional transmission, prevent speculative projects from clogging interconnection queues, and expand federal backstop siting authority can help address concerns around renewable energy deployment that industry players claim will stall progress on clean hydrogen.

Will the government be sending out future additional guidance?

Yes – the Treasury Department had previously indicated that it would provide guidance on how to calculate lifecycle GHG emissions for clean hydrogen by August 16, 2023, but it is now expected by the end of the year.

What other ira incentives are available for hydrogen producers?

In addition to the 45V tax credit, the IRA also significantly modified the 45Q tax credit for CCS—which is used to make blue hydrogen—by increasing its value, expanding eligibility, offering a direct pay option, and extending transferability. (More details can be found in the 45Q brief here.) Note: The 45Q and 45V tax credits are not stackable. Although the 45V tax credit does not expressly restrict any ‘color’ of hydrogen as long as it meets the life cycle emission criteria, the 45Q may offer higher cost savings for blue hydrogen producers since there is no life cycle emissions requirement.

For companies or individuals building hydrogen refueling stations for alternative vehicles in low-income and rural areas, the 30C alternative fuel vehicle refueling property credit provides a tax credit equal to 6% of the cost of a business (up to $100,000 per item of property) of 30% for individuals (up to $1000)

Additional Resources