Research | Policy Briefs

Inflation Reduction Act of 2022

30D 25E 45W

30D (New), 25E (Used), and 45W (Commercial) Tax Credits

Background

The Inflation Reduction Act modifies, extends, and/or implements 3 key tax credits for the purchase of EVs: the 30D credit for new EVs, the 25E credit for used EVs, and the 45W credit for commercial EVs. The IRA extended the 30D tax credit, which was originally enacted in the Energy Improvement and Extension Act of 2008 and amended several times before the passage of the IRA. In addition to extending the credit, the IRA established new rules around critical minerals, battery components, and assembly requirements and also lifted the per manufacturer limit. The 25E and 45W credits are newly established under the IRA.

What are they?

The Inflation Reduction Act offers 3 key tax credits to encourage the deployment and use of personal and commercial electric vehicles (EVs):

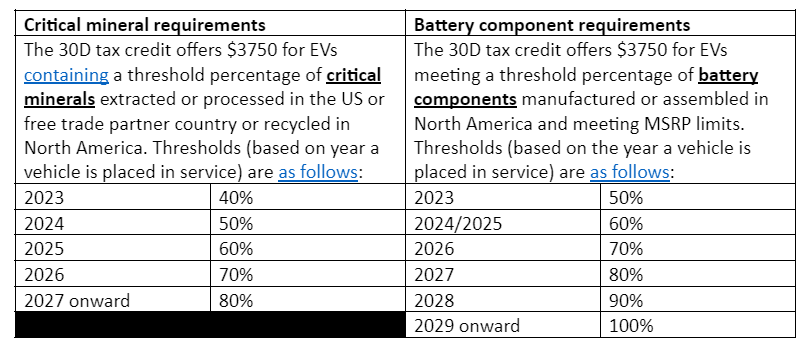

1. 30D (IRA Section 13401): offers $7500 total consumer tax credit for the purchase of new plug-in EVs or fuel cell EVs (FCEVs) meeting critical mineral and battery component requirements

2. 25E (IRA Section 13402): offers a tax credit for the purchase of a used EV or FCEV

Amount is equal to either $4000 or 30% of the sale price (whichever is less)

3. 45W (IRA Section 13403): offers a tax credit for the purchase or lease of qualified commercial clean vehicle

Amount is the lesser of (a) 15% of the vehicle’s cost or 30% for vehicles without internal combustion engines (ICE), or (b) the amount the purchase price exceeds the price of a comparable ICE vehicle

Note: credit capped at $7500 for vehicles less than 14,000 lbs and $40,000 for all other clean vehicles

What types of projects/businesses are eligible?

Eligibility varies based on the tax credit:

1. 30D: individual consumers only

Available to consumers with modified adjusted gross incomes for the current or preceding year less than or equal to $300,000 (couples), $225,000 (heads of household), and $150,000 (singles)

2. 25E: individual consumers only

Available to consumers with modified adjusted gross incomes for the current or preceding year less than or equal to $150,000 (couples), $112,000 (heads of household), and $75,000 (singles)

Can only be claimed once per three years and once per vehicle

Must be sold by a dealer and have a sale price of $25,000 or less

3. 45W: businesses and tax-exempt organizations only

Although there is no limit on the number of credits that can be claimed, the credits are nonrefundable, meaning that businesses cannot receive more on the credit than they owe in taxes.

Note: The 45W tax credit is more flexible than the 30D credit, as there are no income restrictions; North American assembly, critical mineral, or battery component requirements; or ‘entity of concern’ limitations. However, vehicles must meet the following qualifications:

Made by qualified manufacturers, as defined by the IRS

Be used by the business purchasing the vehicles (not for resale)

Be used primarily in the United States

Not have been allowed a tax credit under IRC section 30D

Be treated either as a motor vehicle for purposes of Title II of the Clean Air Act and manufactured primarily for use on public roads or mobile machinery as defined in IRC 4053(8)

Be either a plug-in EV that draws significant propulsion from an electric motor [with a battery capacity of at least 7 kWh if the gross vehicle weight rating (GVWR) is under 14,000 pounds or 15 kWh if the GVWR is 14,000 pounds or more] or fuel cell motor vehicle as defined under IRC section 30D.

How do businesses take advantage of it?

For each of the three credits, the period of availability is for vehicles placed in service from 1/1/2023 to 12/31/2032.

30D: File Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit (Including Qualified Two-Wheeled Plug-in Electric Vehicles), with tax return and provide vehicle VIN.

25E: File Form 8936 (same as for 30D credit) with tax return and provide vehicle VIN.

45W: The IRS is currently finalizing a form for businesses to file to claim the credit. Businesses will be required to provide vehicle VIN and amount of the credit. *Note: The depreciable basis of the vehicle is reduced by the amount of the credit received.

Will the government be sending out future additional guidance?

Two key developments are expected by the start of 2024: 1) clarification regarding foreign entities of concern and 2) the implementation of tax credit transferability. Here is an explanation of each:

1. Definition of ‘foreign entity of concern:’

In addition to updated forms for the 45W and 30C tax credits expected in advance of the 2024 tax filing season, the IRS should issue guidance on ‘foreign entities of concern’ relevant to the 30D tax credit. According to the Inflation Reduction Act, starting in 2024, qualifying vehicles cannot have battery components manufactured or assembled by a ‘foreign entity of concern,’ and from 2025, qualifying vehicles’ batteries cannot contain critical minerals extracted, processed, or recycled by a foreign entity of concern.

While the IRA currently defines a ‘foreign entity of concern’ as a foreign entity “owned by, controlled by, or subject to the jurisdiction or direction of a government of a covered nation (as defined in section 2533c(d) of title 10)”—namely, China, Russia, North Korea, and Iran—the nature and level of ownership required to meet this definition remains unclear. While the CHIPS Act, for example, employs a broad interpretation of the phrase, there are a number of other potential interpretations. The IRS is expected to issue additional guidance to clarify the definition relevant to the 30D tax credit

2. Transferability of tax credit to dealers:

For qualifying clean vehicles purchased in 2023, the 30D tax credit can only be claimed by submitting the relevant form. Thus, the amount claimed in the tax credit cannot exceed the amount owed in taxes. However, starting in 2024, car buyers can transfer the credit to dealers at the point of sale to directly reduce the purchase price.

Additional Resources